BTN – Millennial is Indonesia’s hope to boost the economy in the future. Therefore, it must ensure that the generation can continue to develop by preparing their welfare from an early age.

To accommodate this, BTN confirmed its commitment to designing various banking products and programs. Starting from savings, credit, to digital transaction services to help millennials prepare for the future.

BTN President Director Pahala Nugraha Mansury said the current Corona Virus pandemic or COVID-19 teaches many things. Like, must carefully prepare for the future, including having savings and a house.

As we already know, they have many products to support this. Such as savings for marriage preparation, continuing school, and various other needs through the BTN Batara savings service.

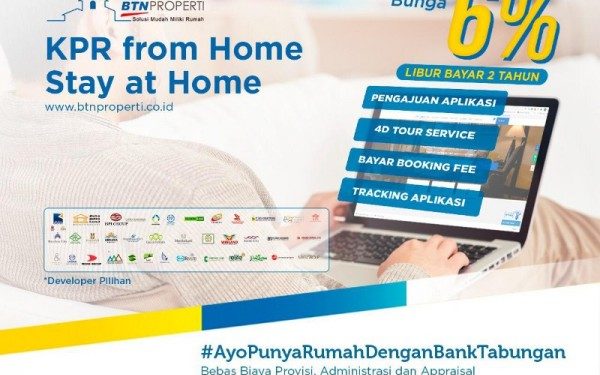

Then he continued, when he had to own his own house, BTN also had a program “KPR Gaeesss” and “BTN Properti portal”.

they also has a variety of transaction innovations to meet the needs of fast and easy banking services.

Meanwhile, in order to support the Indonesian people owning a home,

they will hold the Indonesia Property Expo 2020 from August 22 to September 30, 2020.

The event, which packaged in a 4D virtual digital concept platform,

held in order to provide various housing options for the Indonesian people, both for living and investing.

Later, IPEX Virtual 4D will make it easier for Indonesians to find a property through the ipex.btnproperti.co.id site. Prospective residential buyers can enter the site and then select the area and house to propose. Then, prospective residential buyers can directly pay the booking fee and apply for a KPR online via btnproperti.co.id.

For information, BTN still recorded a positive performance in credit and

financing the distribution of 0.32 percent on an annual basis (year-on-year / yoy). From Rp251.04 trillion in the semester I / 2019 to Rp251.83 trillion in the same period this year.

BTN Subsidized Housing Loans (KPR) are recorded as contributing to overall BBTN credit growth.

With a share of 45.11 percent of the total loan portfolio at Bank BTN,

it grew positively at the level of 5.84 percent yoy.

As of semester I / 2020, BTN subsidized KPR was recorded to have increased

from Rp107.34 trillion in the first semester of 2019 to Rp113.61 trillion.

In the housing loan segment, BTN has also distributed non-subsidized KPR,

other housing loans, and construction loans of IDR 79.87 trillion,

IDR 7.56 trillion, and IDR 27.87 trillion per semester I / 2020, respectively.

With this distribution, the total KPR at BTN grew by 2.47 percent yoy from Rp. 188.82 trillion to Rp. 193.49 trillion as of June 30, 2020.