As we know, taxes contribute a large amount of income in order to realize development in all fields.

It is proven that the contribution of state and regional income from taxes tends to increase from year to year.

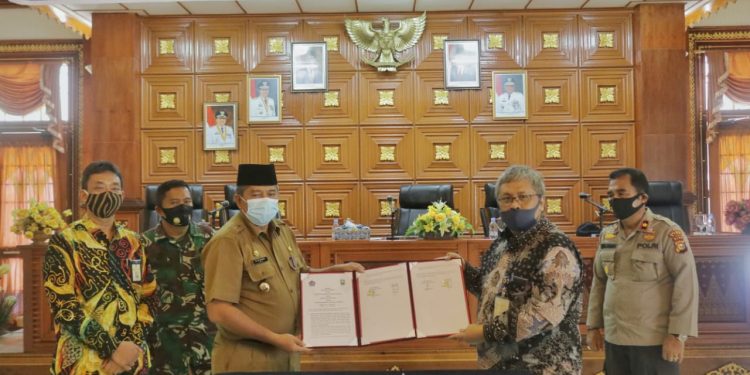

The Regent of Siak, Alfedri signed a Memorandum of Understanding (MoU) with the Head of the Regional Office of the Directorate General of Taxes (DJP) of Riau Edward Hamonangan Sianipar, in the Meeting Room of Raja Indra Pahlawan, Second floor in the Siak Regent’s Office.

“The signing of the MoU was carried out in order to produce similar programs and policies related to the optimization of tax revenue as a source of central and regional income,” said Regent Alfedri at the beginning of his speech.

Alfedri also said that this collaboration was intended to increase regional income from the tax sector in order to increase the Regional Original Income (PAD) which would be earmarked for regional development of Siak Regency.

“The regional government and the Tax Directorate will work together to optimize all forms of potential tax revenue in the Siak Regency area. In addition, it is also a form of commitment and compliance with the importance of increasing taxes for development,” he said.

In addition, the Regent also said that the signing of a memorandum of understanding in this regard was not the first.

“This MoU is a continuation because previously a memorandum of understanding was signed in May 2019 ago. But this time there are several addendums, including Tax on Acquisition of Land and Building Rights and Trading Business Tax”, he explained.

Regarding efforts to increase regional income from tax retribution, Regent Alfedri explained that since the last year the Siak Regency Government has issued various policies, including through application tools on cash registers (tapping boxes).

“Regarding our efforts to increase regional income from this tax levy, since a year ago we have issued a new policy that makes it easier for the public to pay taxes through 61 application tools in the cash register (tapping box) for businesses in various sub-districts, even to the village”, he explained.

Alfedri believes that the tax revenue in the Siak Regency can still be increased as Micro, Small and Medium Enterprises (MSMEs) in various regions in Siak Regency continue to thrive.

“The increase in income from the tax sector can still be increased, of course, this is inseparable from the active role of the community in cultivating MSMEs which continue to thrive in almost all areas of Siak Regency”, he explained.

At the end of his remarks, the Regent of Siak Alfedri gave his appreciation to the Head of the Regional Office of the Director-General of Taxes (DJP) Riau who had made serious efforts in increasing regional tax revenue, one of which was through the signing of the cooperation.

“I am very grateful to Mr. Edward who has made serious efforts to increase regional income in the tax sector through the signing of this collaboration. I hope synchronization of policy steps and better cooperation in the future for the welfare of the people of Siak Regency”, he concluded.

Previously, the Head of Regional Office of DJP Riau, Edward Hamonangan Sianipar, said that his party is currently focusing on a strategy to expand the tax base and increase the number and quality of data in the field.

As part of this strategy, Edward said that he would conduct a feasibility study for prospective taxpayers which will be carried out from October to December 2020 in Siak Regency.

He added, in the feasibility study, monitoring will be carried out with the Siak Regency Government and the Riau Regional Office of the DJP. This is to form an authentic database in Siak Regency, to facilitate the Siak Regency Government in carrying out activity programs related to increasing revenue from the tax retribution sector.